When buying stuff online, I used to take advantage of offers of "free shipping with the continental states". Ordering stuff from the USA and having it shipped to Ottawa, Canada, was often much more expensive because of brokerage fees etc for cross-border shipping.

But with free shipping within the USA, I'd have the package delivered to and held at the UPS Store in Ogdensburg NY, which is less than an hour's drive from Ottawa. Bringing it back into Canada meant declaring the purchase at the border and paying whatever sales taxes, duties, tariffs applied. I would have needed to pay those fees in any case, paid to UPS or FedEx or DHL or whichever shipping company delivered to Ottawa. But by fetching the parcel myself from Ogdensburg I saved a big chunk on shipping and brokerage fees.

Usually it was car parts for my old BMW. Even though those parts were purchased from a supplier within the USA, those BMW parts were originally manufactured in Germany and thus subject to whatever tariffs apply to German manufactured auto parts. I don't know if those still exist, but at the time Canada did impose an import tariff on German auto parts. It's intended to protect our domestic North American auto industry.

I once ordered a set of four new Yokohama tires this way for my car. What with shipping handling and FedEx brokerage fees etc, the tires would have cost me nearly double the price if purchased from a shop in Ottawa, compared to free shipping within the USA and picking them up myself in Ogdensburg. And, even though Yokohama is a Japanese tire manufacturer, these particular tires were manufactured at Yokohama's US factory located in Virginia. The sidewalls are even stamped "Made in the USA".

Because Canada, Mexico, and the USA have [had!] a Free Trade Agreement, no extra duties or tariffs were applied when I declared the purchase of the tires upon crossing back into Canada.

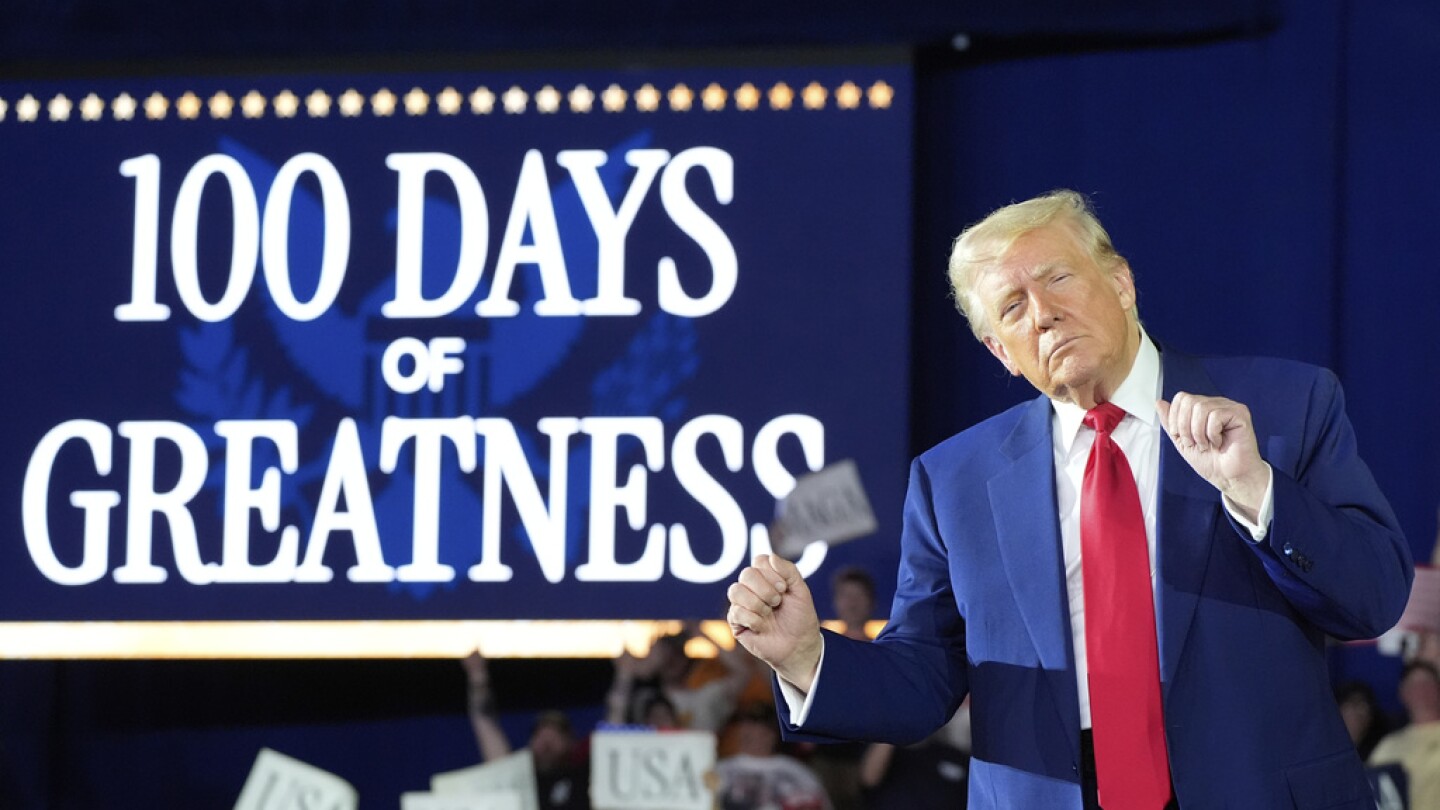

All of that has now been destroyed with tariffs and counter-tariffs and retaliatory tariffs driving cross-border business into the toilet.

I understand the intent. Rather than buying tires from Japan, your administration instead wants more factories to manufacture everything within the USA. Yokohama has two factories in the USA. But it takes time to build new factories. Meanwhile excessive tariffs are hurting everyone.

But with free shipping within the USA, I'd have the package delivered to and held at the UPS Store in Ogdensburg NY, which is less than an hour's drive from Ottawa. Bringing it back into Canada meant declaring the purchase at the border and paying whatever sales taxes, duties, tariffs applied. I would have needed to pay those fees in any case, paid to UPS or FedEx or DHL or whichever shipping company delivered to Ottawa. But by fetching the parcel myself from Ogdensburg I saved a big chunk on shipping and brokerage fees.

Usually it was car parts for my old BMW. Even though those parts were purchased from a supplier within the USA, those BMW parts were originally manufactured in Germany and thus subject to whatever tariffs apply to German manufactured auto parts. I don't know if those still exist, but at the time Canada did impose an import tariff on German auto parts. It's intended to protect our domestic North American auto industry.

I once ordered a set of four new Yokohama tires this way for my car. What with shipping handling and FedEx brokerage fees etc, the tires would have cost me nearly double the price if purchased from a shop in Ottawa, compared to free shipping within the USA and picking them up myself in Ogdensburg. And, even though Yokohama is a Japanese tire manufacturer, these particular tires were manufactured at Yokohama's US factory located in Virginia. The sidewalls are even stamped "Made in the USA".

Because Canada, Mexico, and the USA have [had!] a Free Trade Agreement, no extra duties or tariffs were applied when I declared the purchase of the tires upon crossing back into Canada.

All of that has now been destroyed with tariffs and counter-tariffs and retaliatory tariffs driving cross-border business into the toilet.

I understand the intent. Rather than buying tires from Japan, your administration instead wants more factories to manufacture everything within the USA. Yokohama has two factories in the USA. But it takes time to build new factories. Meanwhile excessive tariffs are hurting everyone.